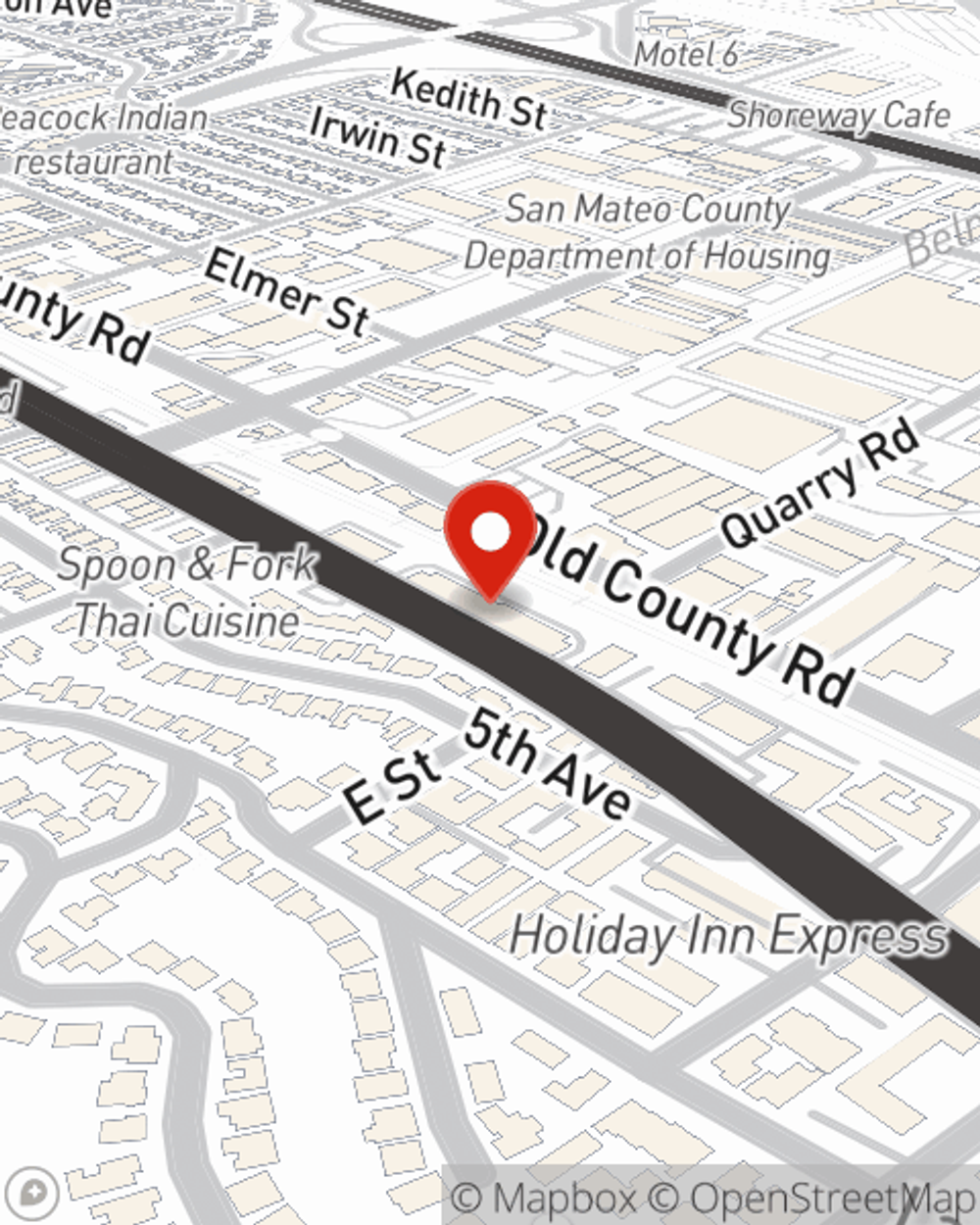

Life Insurance in and around Belmont

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- the Peninsula

- California

- the Bay Area

- San Mateo County

- Belmont

- San Carlos

- Redwood Shores

- Redwood City

- San Mateo

- Foster City

- Burlingame

- Hillsborough

It's Time To Think Life Insurance

Investing in those you love is an honor and a joy. You go to work to provide for them advise them on important decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Life Insurance Options To Fit Your Needs

And State Farm Agent Jim Dwyer is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or coverage for a specific number of years. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Interested in finding out what State Farm can do for you? Contact agent Jim Dwyer today to get to know your specific Life insurance options.

Have More Questions About Life Insurance?

Call Jim at (650) 592-3957 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.